cdxx.ru

Gainers & Losers

Should I Buy Cop Stock

Based on 19 Wall Street analysts who have issued ratings for ConocoPhillips in the last 12 months, the stock has a consensus rating of "Moderate Buy. shares rallying from a low in January. COP · Why Oil Could Fall to Around $50 a Barrel. Investing. Oct 19, AM EDT. PRO. 3 Dividend Stocks to Buy With. Should I buy Conocophillips (COP)? Use the Zacks Rank and Style Scores to find out is COP is right for your portfolio. We've gathered opinions of 30 analysts rating COP stock in the past 3 months. Most of them backed up the strong buy trend, and after taking into account other. In the current month, COP has received 19 Buy Ratings, 5 Hold Ratings, and 0 Sell Ratings. COP average Analyst price target in the past 3 months is $ Historical index on US Stock Market: A+ "Should I invest in Conoco Phillips stock?" "Should I trade "COP" stock today?" According to our live Forecast. This Oil Stock is a Cash-Gushing (and Returning) Machine ConocoPhillips' strategy is paying big dividends for investors. Buy. Overweight. 2. 3. 3. Hold. 7. 8. 8. Underweight. 1. 0 Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq. Over the next 52 weeks, ConocoPhillips has on average historically risen by % based on the past 52 years of stock performance. ConocoPhillips Stock Rating. Based on 19 Wall Street analysts who have issued ratings for ConocoPhillips in the last 12 months, the stock has a consensus rating of "Moderate Buy. shares rallying from a low in January. COP · Why Oil Could Fall to Around $50 a Barrel. Investing. Oct 19, AM EDT. PRO. 3 Dividend Stocks to Buy With. Should I buy Conocophillips (COP)? Use the Zacks Rank and Style Scores to find out is COP is right for your portfolio. We've gathered opinions of 30 analysts rating COP stock in the past 3 months. Most of them backed up the strong buy trend, and after taking into account other. In the current month, COP has received 19 Buy Ratings, 5 Hold Ratings, and 0 Sell Ratings. COP average Analyst price target in the past 3 months is $ Historical index on US Stock Market: A+ "Should I invest in Conoco Phillips stock?" "Should I trade "COP" stock today?" According to our live Forecast. This Oil Stock is a Cash-Gushing (and Returning) Machine ConocoPhillips' strategy is paying big dividends for investors. Buy. Overweight. 2. 3. 3. Hold. 7. 8. 8. Underweight. 1. 0 Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq. Over the next 52 weeks, ConocoPhillips has on average historically risen by % based on the past 52 years of stock performance. ConocoPhillips Stock Rating.

The Stock Looks Attractive but Investors Should be Mindful of Mediocre Growth Record 0. 0. Sell. 0. 0. 0. ConsensusBuyBuyBuy. Stock Price Target. High. Is ConocoPhillips a Buy, Sell or Hold? · The current ConocoPhillips [COP] share price is $ · COP is currently trading in the % percentile range. could be ahead. ByNick CrainContributor. 1 hour ago. Double Your Money Buying What China Refuses To Sell. Buy what China refuses to sell has become a smart. Get the latest on ConocoPhillips common stock, listed on the New York Stock Exchange under the ticker COP, plus dividend history and historical price. The consensus among 13 Wall Street analysts covering (NYSE: COP) stock is to Strong Buy COP stock. Out of 13 analysts, 9 (%) are recommending COP as a. Should I buy Conocophillips (COP)? Use the Zacks Rank and Style Scores to find out is COP is right for your portfolio. You can buy ConocoPhillips (COP) stock and many other stocks or ETFs on Stash. Purchase fractional shares with any dollar amount. Considering the day investment horizon and your highly speculative risk level, our recommendation regarding ConocoPhillips is 'Strong Hold'. A buy or sell. The dividend yield is %. What Is the ConocoPhillips Market Cap? As of today, ConocoPhillips market cap is B. COP News. Wall Street Favorites: 3 Energy Stocks With Strong Buy Ratings for May As oil prices rise, it's worth looking at the top energy stocks to buy in. ConocoPhillips has received a consensus rating of Moderate Buy. The company's average rating score is , and is based on 12 buy ratings, 4 hold ratings. Conocophillips Stock Smart Score ; Analyst Consensus. Strong Buy. Average Price Target: $ (% Upside) ; Blogger Sentiment. Bullish. COP Sentiment 93%. Complete ConocoPhillips stock information by Barron's. View real-time COP stock price and news, along with industry-best analysis ConocoPhillips Should Buy an. ConocoPhillips has a consensus price target of $ based on the ratings of 27 analysts. The high is $ issued by Barclays on May 30, How much is Conocophillips stock worth today? (NYSE: COP) Conocophillips Top Performing AnalystsStock ScreenerStock ForecastTrending StocksStrong Buy Stocks. According to 17 analysts, the average rating for COP stock is "Buy." The 12 ConocoPhillips: Improving Natural Gas Outlook Should Encourage Investors. ConocoPhillips explores for, develops and produces crude oil and natural gas globally. Conoco Phillips ; AM · ConocoPhillips (COP) Earnings Expected to Grow: Should You Buy? (Zacks) ; AM · Why Does Ken Fisher Recommend ConocoPhillips (COP). ConocoPhillips operates as an exploration and production company, which engages in the exploration, production, transport, and marketing of crude oil, bitumen. Return vs Industry: COP underperformed the US Oil and Gas industry which returned % over the past year. Return vs Market: COP underperformed the US Market.

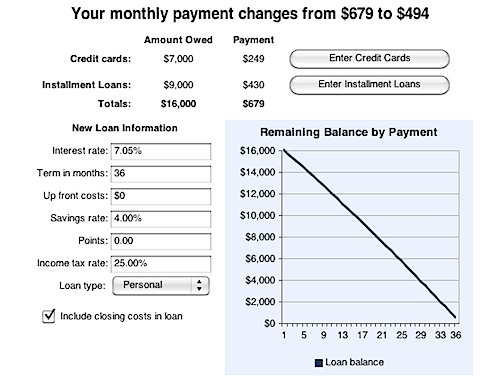

Rates For Debt Consolidation Loans

Your APR will be between % and % based on creditworthiness at time of application for loan terms of months. For example, if you get approved for. Freedom Federal Credit Union is offering debt consolidation loans with a rate as low as a % APR. Take back control, turn your pile of bills into 1 low. As of November 6, , the variable rate for Home Equity Lines of Credit ranged from % APR to % APR. Rates may vary due to a change in the Prime Rate. Make life easier with debt rescue. Anyone who has multiple loans and credit cards knows just how difficult it is to manage all the different rates and terms. Interest rates: % to %. · Loan amounts: $5, to $, · Repayment terms: 2 to 7 years. · Discounts and perks: Direct lender payment discount (%). As of November 6, , the variable rate for Home Equity Lines of Credit ranged from % APR to % APR. Fixed rates from % APR to % APR reflect the % autopay interest rate discount and a % direct deposit interest rate discount. SoFi rate ranges. Debt Consolidation Loan: Annual Percentage Rate (APR) effective as of 08/08/ All loans subject to credit review and approval. Payment example for a 72 month. With Personal Loan rates as low as % APR 1, now may be a great time to take care of your finances. Get started by checking your rates. Apply when you're. Your APR will be between % and % based on creditworthiness at time of application for loan terms of months. For example, if you get approved for. Freedom Federal Credit Union is offering debt consolidation loans with a rate as low as a % APR. Take back control, turn your pile of bills into 1 low. As of November 6, , the variable rate for Home Equity Lines of Credit ranged from % APR to % APR. Rates may vary due to a change in the Prime Rate. Make life easier with debt rescue. Anyone who has multiple loans and credit cards knows just how difficult it is to manage all the different rates and terms. Interest rates: % to %. · Loan amounts: $5, to $, · Repayment terms: 2 to 7 years. · Discounts and perks: Direct lender payment discount (%). As of November 6, , the variable rate for Home Equity Lines of Credit ranged from % APR to % APR. Fixed rates from % APR to % APR reflect the % autopay interest rate discount and a % direct deposit interest rate discount. SoFi rate ranges. Debt Consolidation Loan: Annual Percentage Rate (APR) effective as of 08/08/ All loans subject to credit review and approval. Payment example for a 72 month. With Personal Loan rates as low as % APR 1, now may be a great time to take care of your finances. Get started by checking your rates. Apply when you're.

5. The full range of available rates varies by state. A representative example of payment terms for an unsecured Personal Loan is as follows: a borrower. How do I get a debt consolidation loan? · Decide what type of loan you want. You have a variety of options to help you consolidate debt—a low-rate credit card. Average Debt Consolidation Rates ; The latest APRs ; Average overall rate, % ; Average low rate, % ; Best rate, %. Rates range from % – % APR w/ AutoPay. Reach Financial: Best for quick funding. Reach Financial logo · 14 · % - % · Free monthly credit score ; Upstart: Best for borrowers with bad credit. Switch to Save with a Patelco Credit Card. With a lower credit card rate, you can save on interest and pay down balances faster with no transfer fee. If a member qualifies for interest rate lower than the offered rate, then the lower rate will be applied to the loan. For this unsecured loan, financing at. Example chart shows calculations based on a 5 year SoFi Personal Loan with a fixed rate of % APR, which is the rounded average median funded APR. Disadvantage: Risk of higher interest rates after a promotional period if the debt isn't fully paid. Debt Consolidation Loan: Obtain a loan from a bank or. Repay a personal loan in terms of months. Rates range from % to % Annual Percentage Rate (APR)Footnote 4, which includes a relationship discount. Debt consolidation loan interest rates range from about 6% to 20%. What qualifies for a good debt consolidation rate ultimately comes down to your individual. Compare debt consolidation loan rates from top lenders for September ; LightStream · · Loan term. 2 - 7 years ; Upstart · · Loan term. 3, 5. The Debt Consolidation Calculator can determine whether it is financially rewarding to consolidate debts by comparing the APR (Annual Percentage Rate) of the. Personal loans made through Upgrade feature Annual Percentage Rates (APRs) of %%. All personal loans have a % to % origination fee, which is. For many Canadians, debt consolidation loans can lead to even more financial stress. High-interest loans and hidden fees could lead to payments that exceed the. A Direct Consolidation Loan has a fixed interest rate for the life of the loan. The fixed rate is the weighted average of the interest rates on the loans. Lower overall interest rates – If you have high interest debts like credit card balances, a debt consolidation loan will have a lower interest rate. · One single. By combining multiple balances into a new loan with a lower interest rate, you can reduce cumulative interest, which is the sum of all interest payments made. Combine multiple higher-rate loans into one manageable payment. Since it is a fixed rate, it will help with budgeting too as you always know the payment amount. A debt consolidation loan is where you apply for a personal loan with the intent to pay off your debts, preferably with a lower interest rate than what you're.

Housing Loan Interest Rates Usa

The current average year fixed mortgage rate climbed 2 basis points from % to % on Monday, Zillow announced. The year fixed mortgage rate on. Today's loan purchase rates ; VA Purchase Loan, InterestSee note%, APRSee note2 %, Points ; VA Jumbo Purchase Loan, InterestSee note1 %, APR. Today's competitive mortgage rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. Compare current mortgage interest rates and see if you qualify for a% interest rate discount. Contact a Mortgage Loan Officer today! Meanwhile, the rate for jumbo loans, or the year mortgage for homes sold for over $,, was %, down from %. The average rate for a year. Refinance Lower your interest rate or monthly payment, or shorten your loan term Canadian resident looking for a mortgage in the USA? Learn more · Get. Today's competitive mortgage rates ; year fixed · % ; year fixed · % ; 5y/6m ARM · %. Monthly principal and interest payments will be $ with a corresponding interest rate of %. Disclosures: The CommunityWorks program is only available. On Wednesday, September 04, , the current average interest rate for the benchmark year fixed mortgage is %, declining 2 basis points from a week ago. The current average year fixed mortgage rate climbed 2 basis points from % to % on Monday, Zillow announced. The year fixed mortgage rate on. Today's loan purchase rates ; VA Purchase Loan, InterestSee note%, APRSee note2 %, Points ; VA Jumbo Purchase Loan, InterestSee note1 %, APR. Today's competitive mortgage rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. Compare current mortgage interest rates and see if you qualify for a% interest rate discount. Contact a Mortgage Loan Officer today! Meanwhile, the rate for jumbo loans, or the year mortgage for homes sold for over $,, was %, down from %. The average rate for a year. Refinance Lower your interest rate or monthly payment, or shorten your loan term Canadian resident looking for a mortgage in the USA? Learn more · Get. Today's competitive mortgage rates ; year fixed · % ; year fixed · % ; 5y/6m ARM · %. Monthly principal and interest payments will be $ with a corresponding interest rate of %. Disclosures: The CommunityWorks program is only available. On Wednesday, September 04, , the current average interest rate for the benchmark year fixed mortgage is %, declining 2 basis points from a week ago.

As of September 2, , the average year-fixed mortgage APR is %. Terms Explained. 3. (2) (A) You must contact us and request to exercise the no-refi rate drop option; (B) the reduced interest rate for your loan must be at least % lower than. A Department of Veterans Affairs (VA) Interest Rate Reduction Refinance Loan home on Federal Trust land or to reduce the interest rate. U.S. Department. For example, the monthly principal and interest payment (not including taxes and insurance premiums) on a $,, year fixed mortgage at 6% interest is. The following tables are updated daily with current mortgage rates for the most common types of home loans. Search for rates by state or compare loan terms. Get Today's current mortgage and refinance interest rates and compare a variety of Pennymac loan products, including VA, fixed, ARM, Jumbo and more. Home interest rates have varied widely since Freddie Mac began tracking them in The first time the monthly average rate for a year fixed-rate mortgage. Today's Rate on a Year Fixed Mortgage Is % and APR % In a year fixed mortgage, your interest rate stays the same over the year period. Other restrictions and limitations apply. Home lending products provided by JPMorgan Chase Bank, N.A. Member FDIC. Follow us. September mortgage rates currently average % for year fixed loans and % for year fixed loans. · Mortgage Purchase rates in Charlotte, NC · Current. Mortgage Rates Continue to Drop. August 29, Mortgage rates fell again this week due to expectations of a Fed rate cut. Rates are expected to continue. The average rate on the benchmark year mortgage fell 11 basis points from % to % for the week ending August 29, according to Freddie Mac data. A. The average interest rate is % for a year, fixed-rate mortgage in the United States, per mortgage technology and data company Optimal Blue. New home purchase ; year fixed mortgage · % ; year fixed mortgage · % ; % first-time-homebuyer · % ; year first-time homebuyer with 30 Year Mortgage Rate in the United States averaged percent from until , reaching an all time high of percent in October of and a. You'll have to complete a loan application to see mortgage interest rates. American Funding: NMLS# Great for first-time home buyers | customer. Today's Rate on a Year Fixed Mortgage Is % and APR % In a year fixed mortgage, your interest rate stays the same over the year period. TODAY'S MORTGAGE RATES If you like a rate, apply today. ; % · % APR · % · % · % APR ; % · % APR · % · % · % APR ; %. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. The best way to get your current mortgage rate is to let us estimate it based on your unique details. Home loan interest rates are calculated using details.

Overwhelmed With Credit Card Debt

Strangely enough, get a credit card if you can. Find one that's interest free for a year or so. Transfer any balances you can. There will be a. getting overwhelmed by credit card debt. But it also offers an opportunity to teach your teen about responsible use of credit cards. If you decide to co. 1. If you're in a bind, talk to your credit card issuer · 2. Identify the cause of your credit card debt · 3. Choose a payoff strategy that works for you · 4. With a debt settlement, you can negotiate with the credit card company for a lower balance. In many cases, you can settle your debt for less than the amount. Debt Relief Services. If you find yourself overwhelmed by your debt and are at Touts a "new government program" to bail out personal credit card debt. Strategies to help pay off credit card debt fast · 1. Review and revise your budget. · 2. Make more than the minimum payment each month. · 3. Target one debt at a. Often, credit card debt becomes overwhelming due to high-interest rates. Review your cards and identify those with the highest rates. You can transfer these. Unsecured Credit Debt Services · One way to get rid of credit card debt is to pay it off, but when you can only afford monthly minimum payments, it can take. Analyze your situation. · Consider bankruptcy. · Consider going to a credit counseling service. · Prioritize the debt you need to pay. · Talk to your credit card. Strangely enough, get a credit card if you can. Find one that's interest free for a year or so. Transfer any balances you can. There will be a. getting overwhelmed by credit card debt. But it also offers an opportunity to teach your teen about responsible use of credit cards. If you decide to co. 1. If you're in a bind, talk to your credit card issuer · 2. Identify the cause of your credit card debt · 3. Choose a payoff strategy that works for you · 4. With a debt settlement, you can negotiate with the credit card company for a lower balance. In many cases, you can settle your debt for less than the amount. Debt Relief Services. If you find yourself overwhelmed by your debt and are at Touts a "new government program" to bail out personal credit card debt. Strategies to help pay off credit card debt fast · 1. Review and revise your budget. · 2. Make more than the minimum payment each month. · 3. Target one debt at a. Often, credit card debt becomes overwhelming due to high-interest rates. Review your cards and identify those with the highest rates. You can transfer these. Unsecured Credit Debt Services · One way to get rid of credit card debt is to pay it off, but when you can only afford monthly minimum payments, it can take. Analyze your situation. · Consider bankruptcy. · Consider going to a credit counseling service. · Prioritize the debt you need to pay. · Talk to your credit card.

Unsecured Credit Debt Services · One way to get rid of credit card debt is to pay it off, but when you can only afford monthly minimum payments, it can take. One of the most expedient and affordable ways to deal with credit card debt is to hire an attorney who can evaluate your case and provide you with multiple. Check your local public library, which may offer credit counseling services. An internet search will reveal if there's one near you. One caution: Just because a. Spot the signs of debt stress in your life; Talk to someone you trust about your worries; Get debt advice if you need it; Make your creditors aware of any. Learn how you can create a debt payment plan, update your budget and prioritize your debts to get out of debt faster with these tips. If you're feeling burdened by debt, you're not alone. The Federal Reserve Bank of NY reported that credit card debt jumped by 13% in the second quarter of. The "snowball method," simply put, means paying off the smallest of all your loans as quickly as possible. If any of this sounds familiar, you're not alone. And one of the first things you should do, according to Waterman, is to understand that your credit card debt. Creditor Participation: Credit Card Debt Forgiveness programs have relationships with creditors who have agreed to participate. Clients who have accounts with. The accumulation of credit card debt can become overwhelming in a hurry. Even if you only plan to use credit cards in an emergency, if that emergency lasts. Pay more than the required minimum by your due date if you can. If you are feeling overwhelmed by credit card debt, seek out legitimate credit counseling. We can consolidate that debt with a secured loan and pay it off in 5 years or less at a much lower interest rate, saving you thousands of dollars and earning. Overwhelmed by credit card debt? These top debt relief providers can help. · · . Last viewed on: Aug 18, Debt Relief and Credit Counseling Once you've obtained credit, it's easy to be overwhelmed. You may overspend, become ill or lose your job. Consider Consolidating Your Debt Debt consolidation can be a good strategy if you have good credit and are feeling overwhelmed by the number of debt payments. What are the top credit card debt solutions? · Debt Consolidation · Debt Management Plan · Debt Settlement · Bankruptcy · What best describes your situation? Struggles with credit card debt often lead to stress and anxiety, which can affect your quality of life. Chronic stress from debt can also lead to sleep. With a debt settlement, you can negotiate with the credit card company for a lower balance. In many cases, you can settle your debt for less than the amount. Overwhelmed by credit card debt? These top debt relief providers can help. · · . Last viewed on: Aug 18, Using your credit card is a quick fix when cash is tight, but it is an expensive one. Try to avoid using your credit card except for emergencies—events that.

Stock Market Symbol For Crude Oil

The symbol is USO and it trades on the New York Stock Exchange. Get the latest US Crude Oil Spot prices in realtime including live charts, historical data, news and analysis. Follow live Oil - Crude price and trace the. Crude Oil WTI (NYM $/bbl) Front Month ; 52 Week Range - ; Open Interest , ; 5 Day. % ; 1 Month. % ; 3 Month. %. Commodities ; CL WTI Crude Oil. ; BZC Brent Crude Oil. ; NG Natural Gas. ; GC Gold. 2, ; SI Silver. The NYMEX Crude Oil contract is traded on the New York Mercantile Exchange, which is now part of the Chicago Mercantile Exchange, under the symbol CL. The. Two major benchmarks for pricing crude oil are the United States' WTI (West Texas Intermediate) and United Kingdom's Brent. The differences between WTI and. Get WTI Crude (Oct'24) (@CLNew York Mercantile Exchange) real-time stock quotes, news, price and financial information from CNBC. Gain direct exposure to the crude oil market using CME Group West Texas Intermediate (WTI) Light Sweet Crude Oil futures, the world's most liquid oil. View the latest Crude Oil WTI (NYM $/bbl) Front Month Stock (CLUS) stock price, news, historical charts, analyst ratings and financial information from. The symbol is USO and it trades on the New York Stock Exchange. Get the latest US Crude Oil Spot prices in realtime including live charts, historical data, news and analysis. Follow live Oil - Crude price and trace the. Crude Oil WTI (NYM $/bbl) Front Month ; 52 Week Range - ; Open Interest , ; 5 Day. % ; 1 Month. % ; 3 Month. %. Commodities ; CL WTI Crude Oil. ; BZC Brent Crude Oil. ; NG Natural Gas. ; GC Gold. 2, ; SI Silver. The NYMEX Crude Oil contract is traded on the New York Mercantile Exchange, which is now part of the Chicago Mercantile Exchange, under the symbol CL. The. Two major benchmarks for pricing crude oil are the United States' WTI (West Texas Intermediate) and United Kingdom's Brent. The differences between WTI and. Get WTI Crude (Oct'24) (@CLNew York Mercantile Exchange) real-time stock quotes, news, price and financial information from CNBC. Gain direct exposure to the crude oil market using CME Group West Texas Intermediate (WTI) Light Sweet Crude Oil futures, the world's most liquid oil. View the latest Crude Oil WTI (NYM $/bbl) Front Month Stock (CLUS) stock price, news, historical charts, analyst ratings and financial information from.

CL00 | A complete Crude Oil Continuous Contract futures overview by MarketWatch. View the futures and commodity market news, futures pricing and futures. Brent Crude Oil Exchange Traded Commodities ; FBRT, WisdomTree Brent Crude Oil Longer Dated, ; CRUD, WisdomTree WTI Crude Oil, Micro WTI Crude Oil, /MCL, Yes, $, = $ ; E-mini Crude Oil, /QM, No, $, = $ Detailed market information including crude oil price spreads, trade updates, industry officials' commentary, future settlement prices, and much more. Instrument Name Crude Oil WTI Instrument Symbol (CLV24). Instrument Exchange NYMEX · Previous Close · Volume · Open Interest · Volatility (14d) · Stochastic %K (14d). Energies Futures Symbols ; HO, NY Harbor ULSD/Heating oil, NYM ; HU, Unleaded Gas, NYM ; NG, Natural Gas, NYM ; RB, RBOB Gasoline, NYM. Get the latest Crude Oil (CLY00) real-time quote, historical performance, charts, and other financial information to help you make more informed trading and. Crude Oil WTI Futures - Oct 24 (CLV4) ; Prev. Close: ; Open: ; Day's Range: ; 52 wk Range: ; 1-Year Change: %. Dollar sign with checkmark. Cost-effective trading on one of the world's most active commodities ; Candlesticks in charting. High liquidity compared to many. Follow today's crude oil price moves and key news stories driving oil price actions, as well as developments in the broader energy sector. Prices - CME West-Texas Intermediate (WTI) crude oil prices (cdxx.ru symbol CL) traded sideways to lower the first half and posted a 2-year low in May. Oil Price: Get all information on the Price of Oil including News, Charts and Realtime Quotes. Get Crude Oil Front Month Futures (CLc1) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. A high-level overview of Crude Oil Futures (CL1:COM) stock. Stay up to date on the latest stock price, chart, news, analysis, fundamentals, trading and. Crude Oil Expiry v/s Crude Oil Other Contracts ; /1 BBL · ; /1 BBL. 0. ; /1 BBL · 0. 0. Complete Crude Oil WTI (NYM $/bbl) Front Month futures overview by Barron's. View the CL.1 futures and commodity market news with real-time price data for. The ICE Brent Crude futures contract is a deliverable contract based on EFP delivery with an option to cash settle. Market Specifications. Trading Screen. Crude Oil & Natural Gas ; JPY/kl, 71,, +, +% ; USD/MMBtu, , , %. The most widely traded WTI Crude Oil contracts (CL) are traded on the NYMEX, one of four exchanges owned by the CME Group. Brent Crude's primary exchange is the. What drives crude oil prices: Overview ; Composition of the Dow Jones UBS commodity index, Annual, ; Correlations between daily returns on crude oil &.

Interest Rate On A Savings Account

Chase Savings℠ account earns interest, see current rates. Learn how interest rate on savings accounts is compounded & credited monthly. The national average for this type of account is % APY, based on rates published in the FDIC Monthly National Rates and Rate Caps accurate as of 8/19/ Review Bank of America's interest rates and annual percentage yields (APYs) for checking, savings, CD and IRA accounts specific to your area. A bank is a private business, so generally, it sets its own interest rates on savings accounts. High-Rate Savings Account Features · Bank anytime, anywhere with Alliant Mobile and Online Banking · Earn our best rate on all of your money with only a $ Competitive Rates. Earn % APY — well above the national average. Best High-Yield Savings Account Rates for August Poppy Bank – % APY; Flagstar Bank – % APY; Western Alliance Bank – % APY; Forbright Bank –. Savings and interest checking account rates are based on the $2, product tier, while money market and certificate of deposit rates represent an average of. The best high-yield savings accounts have annual percentage yields, or APYs, that are about 10 times higher than the national average rate of %. Many of. Chase Savings℠ account earns interest, see current rates. Learn how interest rate on savings accounts is compounded & credited monthly. The national average for this type of account is % APY, based on rates published in the FDIC Monthly National Rates and Rate Caps accurate as of 8/19/ Review Bank of America's interest rates and annual percentage yields (APYs) for checking, savings, CD and IRA accounts specific to your area. A bank is a private business, so generally, it sets its own interest rates on savings accounts. High-Rate Savings Account Features · Bank anytime, anywhere with Alliant Mobile and Online Banking · Earn our best rate on all of your money with only a $ Competitive Rates. Earn % APY — well above the national average. Best High-Yield Savings Account Rates for August Poppy Bank – % APY; Flagstar Bank – % APY; Western Alliance Bank – % APY; Forbright Bank –. Savings and interest checking account rates are based on the $2, product tier, while money market and certificate of deposit rates represent an average of. The best high-yield savings accounts have annual percentage yields, or APYs, that are about 10 times higher than the national average rate of %. Many of.

Today's Standard Fixed Rate CDs ; 3 month · %. % ; 6 month · %. % ; 1 year · %. %.

The formula for calculating interest on a savings account is: Balance x Rate x Number of years = Simple interest. What's Compound Interest Compared With Simple. See how our high-yield Online Savings Account rate stacks up. ; Annual percentage yield. % Opens modal dialog. Annual Percentage Yield (APY). Advertised. Explore Citi's current rate offerings for savings accounts. Rates may vary between locations and which savings account you open. Member FDIC. 5% for the Gold tier, 10% for the Platinum tier, and 20% for the Platinum Honors tier. An example of how the Booster works with hypothetical interest rates: If. As of Aug. 19, , the national average rate for savings accounts was %, according to the FDIC. You can check out the best high-yield savings. Get started with our basic savings account and earn a market-leading rate of % APY. Plus, you'll have the flexibility to withdraw what you need—anytime. The best 5% interest savings account should offer an APY of around % to %. Anything less than that, and you might not be getting the best deal. Look for. Earn up to % APY when you deposit at least $25, into a new Elite Money Market Account or an existing account that was opened within the last 30 days. The % APY is guaranteed for the first 5 months after account opening. After the promotional period, the account will earn the posted interest rate of the. Savings Builder · Get % interest rate from the day the account is opened through the first Evaluation Day · Continue earning up to % APY by: · Deposit. Summary of Best High-Yield Savings Accounts of ; UFB Portfolio Savings, Up to % APY ; Bask Interest Savings Account, % APY ; Quontic Bank High Yield. A high yield savings account to help reach financial goals with a % Annual Percentage Yield & no minimum balance or service fees. Apply online today! Balance. Relationship Interest Rate. Relationship APY ; $0 or more. %. %. Standard Savings rates · Interest rate · %. You can open a Performance Savings account with a high-yield savings rate in about 5 minutes. How to Calculate Interest Earned on a Savings Account. % annual percentage yield (APY) is only available to customers who maintain at least $, on deposit in their account TD Signature Savings AND link an. Today's rates remain high, with the national average at around % and top banks offering rates of 5% APY or higher. Interest Rates for Personal Accounts ; Checking Accounts · Choice Checking, $ and above, % · Gold Checking ; Savings Accounts · Personal Savings, $ and. The federal funds target rate now sits between % and %. Although most traditional banks still pay very little interest on savings accounts, you may find. Tier 6 $,+ features an annual percentage yield of %. Initial minimum opening deposit to earn the higher interest rate on the Flagstar Savings.

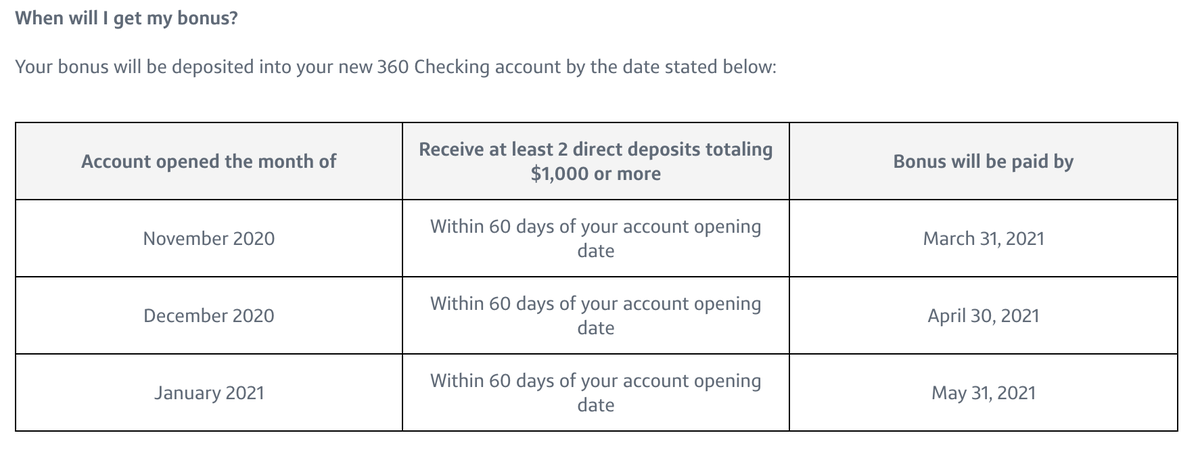

Capital One Sign Up Bonus Rules

as a one-time cash bonus once you spend $ within 3 months of account opening. 2. Low intro APR. 0% intro APR for 15 months on purchases and balance. Capital One generally will only approve you for one card every six months. This rule applies to both personal and business cards, meaning you cannot open a. Existing or previous cardmembers are not eligible for this product if they have received a new cardmember bonus for this product in the past Regarding intro bonuses, you can qualify for a new bonus every 24 months. For example, if you received the Hyatt sign up bonus in and applied for the card. Earn a $1, cash bonus after spending $20, in the first three months and an additional $1, cash bonus after spending $, in the first six months of. For example, Capital One rewards don't expire for the life of the account and there's no limit to how much you can earn. It also might help to remember that the. Sign In. Continue to your account to get your personalized link. ; Share. Send the link to your friends and family. ; Get Your Bonus. Your bonus will. For full details, see official rules · Enter Now · MLB™️ Mondays at Claim your special cardholder discount and sign up today! Terms apply. Sign. Restrictions on welcome offers Amex has the strictest rules on welcome offers, limiting cardholders to just one bonus per card per lifetime. Because of this. as a one-time cash bonus once you spend $ within 3 months of account opening. 2. Low intro APR. 0% intro APR for 15 months on purchases and balance. Capital One generally will only approve you for one card every six months. This rule applies to both personal and business cards, meaning you cannot open a. Existing or previous cardmembers are not eligible for this product if they have received a new cardmember bonus for this product in the past Regarding intro bonuses, you can qualify for a new bonus every 24 months. For example, if you received the Hyatt sign up bonus in and applied for the card. Earn a $1, cash bonus after spending $20, in the first three months and an additional $1, cash bonus after spending $, in the first six months of. For example, Capital One rewards don't expire for the life of the account and there's no limit to how much you can earn. It also might help to remember that the. Sign In. Continue to your account to get your personalized link. ; Share. Send the link to your friends and family. ; Get Your Bonus. Your bonus will. For full details, see official rules · Enter Now · MLB™️ Mondays at Claim your special cardholder discount and sign up today! Terms apply. Sign. Restrictions on welcome offers Amex has the strictest rules on welcome offers, limiting cardholders to just one bonus per card per lifetime. Because of this.

Likely not eligible to earn a sign-up bonus. May not be eligible for an intro Act restricts credit card companies from increasing your annual fee. 60, Bonus Points after you spend $5, on purchases within the first 3 months of account opening.*** Earn an additional 15, Bonus Points after you spend. How to Get % APPROVED for Capital One Credit Cards (Capital One Application Rules ) *BIG UPDATE!* Capital One Venture Bonus, NEW Cash. Earn Up To $2, Bonus Cash Back Or , Miles On The Capital One Spark Cash Plus! · Earn 75, Points, $ Annual Travel Credit, Free Museum Admission. 75, bonus miles. Earn this one-time bonus when you spend $4, within the Sign up for CreditWise from Capital One, a free credit monitoring tool. This product is available to you if you do not have any Sapphire card and have not received a new cardmember bonus for any Sapphire card in the past 48 months. For instance, the Capital One SavorOne Cash Rewards Credit Card is on Select's list of the best cash-back credit cards because of its simple welcome bonus: New. For example, with the Capital One SavorOne Cash Rewards Credit Card that lets new cardholders earn a one-time $ cash bonus once spending $ on purchases. application in Workday. Watch Video: Laura's advice to completing an application at Capital One. I'm a candidate in need of immigration sponsorship. How do. However, it is possible to earn more than one welcome offer by waiting at least 24 months from earning the last bonus. The rule of thumb here would be to close. How To Earn The Bonus The Capital One Checking promotion requires you to set up eligible direct deposits in order to earn the $ bonus (step-by-step. The most important rule to consider in collecting points is the “5/24 rule.” The rule is simple: If you get 5 personal credit cards in any month period, you'. This has to be the primary account holder's first Savings account and it needs a $ minimum deposit. The bonus starts earning interest on day 1, but you. This product is available to you if you do not have this card and have not received a new cardmember bonus for this card in the past 24 months. EARN REWARDS. Bonus is considered income and may be reported on IRS Form INT, MISC, or S, as required by applicable law. UNIQUE OFFER CODE MUST BE PRESENTED. Previous Capital One bank promotions offered a bonus of up to $1, when you opened a new Capital One savings account and met deposit requirements. For full details, see official rules · Enter Now · MLB™️ Mondays at Claim your special cardholder discount and sign up today! Terms apply. Sign. Some people use American Express to buy gift cards without it counting towards the minimum spending requirement for sign-up bonus. You can only get approved for one Capital One card, personal or business, once every 6 months. Existing or previous cardmembers are not eligible for a bonus if. Capital One Quicksilver Student Cash Rewards Credit Card · Earn unlimited % cash back on every purchase, every day · Early Spend Bonus: Earn $50 when you spend.

Florida Solar Incentives

The purchase of photovoltaic systems covered under the Florida Renewable Energy Technologies and Energy Efficiency Act qualifies the consumer to receive a. Florida offers tax incentives and rebates for solar power system installation. In fact, solar systems have been exempted from Florida sales and use tax since. Florida solar incentives like tax credits and rebates allow you to save money when you go solar - learn which incentives are available. Learn about Florida's solar incentives and how they can make solar energy more affordable and beneficial for you. SunVena Solar offers insights and. Florida solar incentives like tax credits and rebates allow you to save money when you go solar - learn which incentives are available. Browse Florida solar incentives, tax credits, and rebates. Find the best incentive programs for your home or commercial solar energy system. You may have heard of the statewide rebate program; Florida's Solar Energy Systems Incentive Program is sadly no longer taking new applicants. The federal credit is for 30% of your entire system cost. In Florida, where residents pay an average of $34, for an average kilowatt (kW) system, the. Florida solar rebates. Florida has no statewide solar rebate program; the few patchwork fill-ins from individual utility companies have closed. You may have. The purchase of photovoltaic systems covered under the Florida Renewable Energy Technologies and Energy Efficiency Act qualifies the consumer to receive a. Florida offers tax incentives and rebates for solar power system installation. In fact, solar systems have been exempted from Florida sales and use tax since. Florida solar incentives like tax credits and rebates allow you to save money when you go solar - learn which incentives are available. Learn about Florida's solar incentives and how they can make solar energy more affordable and beneficial for you. SunVena Solar offers insights and. Florida solar incentives like tax credits and rebates allow you to save money when you go solar - learn which incentives are available. Browse Florida solar incentives, tax credits, and rebates. Find the best incentive programs for your home or commercial solar energy system. You may have heard of the statewide rebate program; Florida's Solar Energy Systems Incentive Program is sadly no longer taking new applicants. The federal credit is for 30% of your entire system cost. In Florida, where residents pay an average of $34, for an average kilowatt (kW) system, the. Florida solar rebates. Florida has no statewide solar rebate program; the few patchwork fill-ins from individual utility companies have closed. You may have.

LEADERS IN SOLAR PROGRAMS Orange County is a top-ranked county in Florida for installed solar on the grid. Solar permits are typically approved within Discover which solar programs is right for you and how we're advancing solar energy in Florida while keeping bills among the lowest in the nation. The Florida Solar Rebate Program offers up to $20, for a residential system installation. The Federal Investment Tax Credit is also available to Florida. The rebate/grant is based on solar panel system capacity. Residents can get $ per watt of solar power generated up to a maximum of $2, Yearly funds are. Orlando OUC Rebates: OUC solar photovoltaic customers can receive a $2, rebate on batteries with usable capacity of 8kWh and a year defect warranty. Residential electric customers can receive up to $ in rebates for installing a solar thermal water heating system. Under Florida Law, property upon which a renewable energy source (Solar Panels) is installed and operated is entitled to an exemption in the amount of the. Florida's Property Tax Exclusion for Residential Renewable Energy Property allows you to add a solar panel system to your home without experiencing any related. This guide provides a comprehensive overview of the Florida solar incentives you can register for when installing a home solar energy system. Florida offers two tax exemptions for solar systems: a sales tax exemption and a property tax abatement. Florida has plenty of financial incentives to make the switch to solar power easier than ever before. State, local, and federal programs can make it easy to. The primary Florida solar incentive is the federal solar tax credit (also known as the renewable energy credit). This credit allows homeowners to claim a. Florida also offers numerous solar incentives to help homeowners save money and maximize their solar investments. Florida solar incentives are the answer. You can save 30% with the current federal solar tax credit if you make the switch to solar. The solar incentives in Florida includes % property tax exemptions. Also, an 80% property tax reduction for commercial solar energy buildings is also. Florida Power and Light offers a solar rebate and all of the utilities governed by the state utilities commission offer net metering. For example, you agree to pay $ per kWh of electricity generated for the next 20 years. The solar company will install and maintain your system and sell the. Florida provides fantastic energy tax credits for solar energy, wind turbines, geothermal energy and energy efficiency. Learn how to save money and go. Learn how you can save money in Florida with a solar photovoltaic (PV) system, including panels from solar power installers Freedom Solar. Taking advantage of Florida's solar incentives can make solar panel installation more affordable and increase your long-term savings. PES Solar is here to help.

Strong Reit To Invest In

For 60 years, Nareit has led the U.S. REIT industry by ensuring its members' best interests are promoted by providing unparalleled advocacy, investor outreach. A REIT (real estate investment trust) is a company that makes investments in income-producing real estate. The best REITs to buy in April based on value, dividends and growth, and how to choose the best REIT investments. Built for growth | PRO Real Estate Investment Trust. We own a portfolio of high-quality commercial properties located in secondary markets with strong. REIT Stock Investing and Analysis ; Hudson Pacific Properties: The Preferreds Have Dipped, But I'm Not Buying · HPP, · Yield ; Realty Income: Still A Crown Jewel. Simon Property Group · Simon Property Group (· the shopping mall REITs and one of the · largest retail REITs in general. Its size and · management strategy work in. REITs can vary by industry, geography and other defining factors, making them particularly great vehicles for building diversification to weather market. Vanguard Real Estate ETF (VNQ): $ billion in assets under management, % in annual expenses, % yield · Schwab U.S. REIT ETF · Real Estate Select. If you're looking to invest in REITs, here are the best companies to invest in for steady income. The figures indicated below are as of February For 60 years, Nareit has led the U.S. REIT industry by ensuring its members' best interests are promoted by providing unparalleled advocacy, investor outreach. A REIT (real estate investment trust) is a company that makes investments in income-producing real estate. The best REITs to buy in April based on value, dividends and growth, and how to choose the best REIT investments. Built for growth | PRO Real Estate Investment Trust. We own a portfolio of high-quality commercial properties located in secondary markets with strong. REIT Stock Investing and Analysis ; Hudson Pacific Properties: The Preferreds Have Dipped, But I'm Not Buying · HPP, · Yield ; Realty Income: Still A Crown Jewel. Simon Property Group · Simon Property Group (· the shopping mall REITs and one of the · largest retail REITs in general. Its size and · management strategy work in. REITs can vary by industry, geography and other defining factors, making them particularly great vehicles for building diversification to weather market. Vanguard Real Estate ETF (VNQ): $ billion in assets under management, % in annual expenses, % yield · Schwab U.S. REIT ETF · Real Estate Select. If you're looking to invest in REITs, here are the best companies to invest in for steady income. The figures indicated below are as of February

Risks aside, REITs do pay dividends, which can be appealing to investors. While REITS are not without risk, they can be a strong part of an investor's portfolio. The best REITs offer instant access to the ever-active real estate market, without any need for a mortgage or a deposit. REITs demonstrate a strong commitment to customer satisfaction by ensuring their residents are happy and comfortable in their homes and communities, which is. Investors should gravitate towards those investments that offer strong, recurring and potentially growing distributions. Canadian REITs are an obvious. What are some of the best REITs to hold long term? I've carried out the research on the following REITs and I'm comfortable investing in them as they're in. BREIT gives individuals the ability to invest with the world's largest commercial real estate owner through a perpetually offered, non-listed REIT. REITs can play an integral role in a balanced investment portfolio because they can offer a strong, stable annual dividend and the potential for long-term. Camden Property Trust invests in multifamily apartment real estate. Founded in , this REIT owns, manages, develops, acquires, and constructs apartment. I usually look for REITs with yields around 5 or 6%, which are a bit lower than my other real estate investments. Then, I look at the REIT dividend history. Retail REIT Stocks FAQ · Retail Opportunity Investments (NASDAQ:ROIC) is the most undervalued retail reit stock based on WallStreetZen's Valuation Score. · Saul. City Office invests in high-quality office properties predominantly in Sun Belt markets with strong economic fundamentals. REITs provide a steady and generally reliable flow of income. In terms of security, apartment-based REITs are especially attractive investments, as they. Well-run, financially strong REITs are an attractive addition to any portfolio. With their long-term capital appreciation potential and ability to generate. Real estate investment trusts (REITs) can offer a unique combination of attractive yields, diversification, and capital appreciation. But is REIT investing. RioCan Real Estate Investment Trust (REIT) is an unincorporated "closed-end Our solid foundation of strong, necessity-based tenants with enduring. The best ones I've found are O, FRT, NNN, DLR, and ESS. I haven't been very impressed with the REIT ETFs like VNQ. In many respects, investment by REITs broadly mirrors wider investment in Canadian real estate. While demand for offices and industrial remains strong, partly. You can invest in REITs by buying stocks or shares in either a publicly traded or privately purchased REIT. Whether a REIT is publicly or privately traded is an. 1. Realty Income Corporation Let's start by talking about the best available REIT for investment in It is a favourite amongst many retail investors and.

Cost To Extend Volvo Cpo Warranty

For Certified cars purchased on or after November 1, , the Certified by Volvo Warranty provides a 5-year/unlimited-mile exclusionary coverage from the. We found that most Volvo owners reported paying between $1, and $4, for coverage, according to our luxury brand survey. Below are the amounts that. We found that most Volvo owners reported paying between $1, and $4, for coverage, according to our luxury brand survey. Below are the amounts that. charge for the remainder of its lifetime. Can I extend the warranty coverage on my Certified by Volvo vehicle? Yes! You can purchase additional coverage up. Your Certified by Volvo warranty is upgradeable for an additional 5 years and up to unlimited miles.*** We also include complimentary roadside assistance and a. In addition to protecting you from the costs of unanticipated mechanical issues, the extended warranty programs include the following coverages: Rental car. Extended Service Contracts offer the added assurance to protect you and your vehicle against unexpected repairs beyond the factory warranty term. Prepaid. Some of the extended warranty options vary and may have mileage limitations. These do cost extra, so determine what works for you. Remember this initial. If you're curious about the Volvo extended warranty cost, you'll normally end up paying anywhere between $1, and $4, depending on your deductible, model. For Certified cars purchased on or after November 1, , the Certified by Volvo Warranty provides a 5-year/unlimited-mile exclusionary coverage from the. We found that most Volvo owners reported paying between $1, and $4, for coverage, according to our luxury brand survey. Below are the amounts that. We found that most Volvo owners reported paying between $1, and $4, for coverage, according to our luxury brand survey. Below are the amounts that. charge for the remainder of its lifetime. Can I extend the warranty coverage on my Certified by Volvo vehicle? Yes! You can purchase additional coverage up. Your Certified by Volvo warranty is upgradeable for an additional 5 years and up to unlimited miles.*** We also include complimentary roadside assistance and a. In addition to protecting you from the costs of unanticipated mechanical issues, the extended warranty programs include the following coverages: Rental car. Extended Service Contracts offer the added assurance to protect you and your vehicle against unexpected repairs beyond the factory warranty term. Prepaid. Some of the extended warranty options vary and may have mileage limitations. These do cost extra, so determine what works for you. Remember this initial. If you're curious about the Volvo extended warranty cost, you'll normally end up paying anywhere between $1, and $4, depending on your deductible, model.

Maintain your car's original, factory-installed safety standards with Volvo Genuine Parts, serviced by Volvo trained technicians, backed by a lifetime warranty†. The warranty is fully transferable to the new owner at no charge for the remainder of its lifetime. Can I extend the warranty coverage on my Certified by Volvo. Extend your Certified by Volvo coverage up to 10 years with unlimited miles for worry-free journeys. Learn more. Volvo Protection Plan. Looking to upgrade your "Certified by Volvo" 5 Year/Unlimited Mile Warranty? We've got you covered. BROWSE CPO UPGRADE PLANS NOW. Request More Info. The warranty is fully transferable to the new owner at no charge for the remainder of its lifetime. Can I extend the warranty coverage on my Certified by Volvo. For Certified cars purchased on or after November 1, , the Certified by Volvo Warranty provides a 5-year/unlimited-mile exclusionary coverage from the. The warranty is fully transferable to the new owner at no charge for the remainder of its lifetime. Learn More. Can I extend the warranty coverage on my. Upgrade to a Maximum of 10 Years If you're like many of our clients, you might want to consider upgrading your 5 Year / Unlimited Mileage Factory Warranty to. Some of the extended warranty options vary and may have mileage limitations. These do cost extra, so determine what works for you. Remember this initial. Can I extend the warranty coverage on my Certified by Volvo vehicle? Yes The Authorized Volvo Car retailer determines final sale price, base MSRP. Your Certified by Volvo warranty is upgradeable for an additional 5 years and up to unlimited miles.*** We also include complimentary roadside assistance and a. Volvo extended warranty cost with coverage list. Factory-backed warranty. Exclusions list. Best Volvo extended warranty: Platinum. Cost: $ Warranty is transferable to subsequent owners at no cost; The CARFAX Can I extend the warranty coverage on my Certified by Volvo vehicle? Yes. Maintain your car's original, factory-installed safety standards with Volvo Genuine Parts, serviced by Volvo trained technicians, backed by a lifetime warranty†. Extended Warranty. The warranty offers full protection against the cost or replacement of any factory fitted mechanical or electrical component which suffers a. A range of plans is available that can back your CPO Volvo vehicle for up to 10 years with unlimited mileage. These extended warranty policies can reimburse you. Warranty is transferable to subsequent owners at no cost; The CARFAX Can I extend the warranty coverage on my Certified by Volvo vehicle? Yes. I got the 10 year unlimited CPO extension down to $ish. Is it worth it? I feel like it absolutely is. Purchasing your Volvo VIP Extended Warranty Service Contract Plan has never been easier at Steingold Volvo Cars in Pawtucket, RI. ONE YEAR / UNLIMITED KM COMPREHENSIVE WARRANTY** The factory-backed warranty fully covers every part of your Certified by Volvo vehicle that is not.

2 3 4 5 6 7